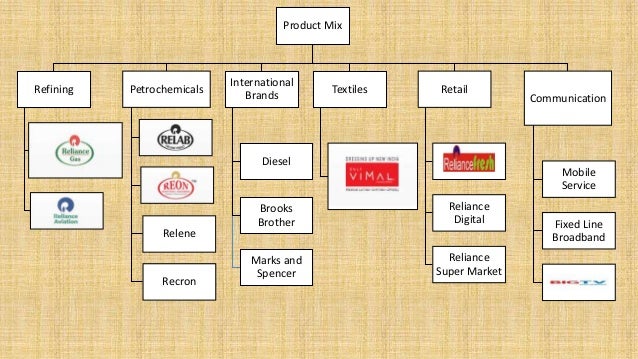

RIL or Reliance Industries Limited is the holding and Conglomerate Company of India, whose headquarter is located in Maharashtra, Mumbai, India. The company owns several other businesses across the India, by engaging in petrochemical, energy, natural resources, textile, telecommunications and retail. The Reliance is known as one of the leading and most profitable company of India, and ranked as the biggest “publicly trading company’ in India by the market capitalization. It is the second leading company in terms of revenue generation in India. The Reliance Industries has the honor to be a first company in India who breached market capitalization of $100 billion. As the company is operating different businesses, it is necessary for the company to evaluate which business is profitable for Reliance industries, and which needs to shut down. This could be done easily with the help of BCG matrix (RIL, 2018).

BCG matrix is a framework created by Boston Consulting Group to evaluate the strategic position of the business brand portfolio and its potential. It classifies business portfolio into four categories based on industry attractiveness and competitive position. You can edit this template on Creately's Visual Workspace to get started quickly. . Created by Bruce D Henderson for the Boston Consulting Group in 1970. Analysis of business units and its product line. Allocation of resources. Analytical tool in brand marketing, product management, strategic management, and portfolio analyses.Market Growth Rate - is defined as the rise in sales or market. A perfect example to demonstrate BCG matrix could be the BCG matrix of Pepsico. The company has perfected its product mix over the years according to what’s working and what’s not. Here are the four quadrants of Pepsico’s growth-share matrix: Cash Cows – With a market share of 58.8% in the US, Frito Lay is the biggest cash cow for Pepsico. From the IE matrix we came to know that RIL is in good position to move ahead with Grow and build Strategy, intensive and aggressive tactical Strategy. Further these are confirmed with the help of BCG and SPACE matrix, finally after the implementation of QSPM we came to the point that diversifying it business vertical can be a better option. 4.2 Boston Consulting Group (BCG) Matrix. The growth–share matrix (BCG-matrix, Boston matrix, Boston Consulting Group analysis, portfolio diagram) is a chart that was created by Bruce D. Henderson for the Boston Consulting Group in 1970 to help corporations to analyze their business units. Is a business model.

Bcg Matrix Of Reliance Pdf Converter

BCG matrix helps in categorizing the products or the business units among four quadrants, which are; stars, cash cows, dogs and question marks. Guna tamil audio songs free download. The analysis is done by considering two main aspects, which are, market growth and market share. The businesses are analyzed in this manner for the companies to make effective decisions (Hanlon, 2018). The BCG matrix of Reliance Industries Limited is as follows;

Cash Cows

Cash Cow quadrant in the BCG matrix is comprised of the products, which have low market growth but high market share in their relevant industry. In addition to this, the industry has the potential to grow but efficient strategies are needed to be made. The company plays in volumes, thus satisfying the high demand of the consumers. Rangers Farm limited is the cash cow for the Reliance industries, as it deals in fruits, vegetables and other consumer products which has not achieved much dominant space in the market. Low level of growth is been observed here with high level of investment (Gandhi, 2009).

Stars

According to a framework of the BCG matrix, the star products possess the high market share and also the high level of market growth rate, which means products have the good future ahead in the industry and still progressing. To be a star product, it is necessary for it to be a good income source, and has the high market share. The rating of the Reliance Industries Limited has reflected on the global scale of the company’s integrated operations with powerful position among rivals in the core oil refining and petrochemical industries with intermediate risk of the financial profiles (RIL, 2018).

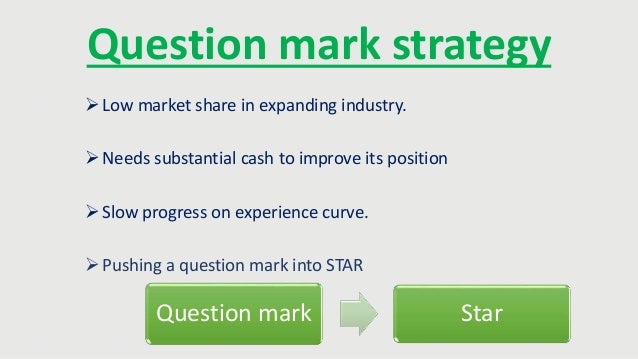

Question Marks

This matrix also pay attention on services or products, which seems to have unpredictable future and termed it as the question mark or the problem child, because they need special attention of the management. Such products can become the prime candidate for a company because of poor performance, or become a success case by bringing good amount of earning in the company. Reliance Petroleum Limited is the question mark in the present market condition of the company. It is equalizing the growth rate but low level of investment (Sayan, 2018; RIL, 2018).

Dogs

The dogs consist of the products which are performing poorly and bringing no return in the company. It has low market share and low market growth rate. The low percentage of income reflects to the low sales value and the reason could be anything. The continuous low profits despite of the investments, might cause it towards divestment. The business of petrochemical is in danger because of recession. The revenue falls to $10.4 billion marginally. This caused the low market share in highly low rate of growth (Gandhi 2009).

References

Gandhi, A. 2009. Bcg Matrix + Porters Five Force Model. [Online], Available at: https://www.slideshare.net/anujgandhi30/bcg-matrix-porters-five-force-model-anuj-gandhi, [Accessed on: 4th September, 2018].

Hanlon, A. 2018. How to use the BCG Matrix model. [Online], Available at: https://www.smartinsights.com/marketing-planning/marketing-models/use-bcg-matrix/, [Accessed on: 4th September, 2018].

RIL, 2018. About Us. [Online], Available at: http://www.ril.com/OurCompany/About.aspx, [Accessed on: 4th September, 2018].

Sayan, 2018. Reliance Industries Limited. [Online], Available at: http://www.authorstream.com/Presentation/sayantanhitk-1538487-reliance-inustries-limited-oec/, [Accessed on: 4th September, 2018].

BCG MATRIX OF PEPSI PDF

The matrix is misrepresenting in some cases. Example: Coca Cola and Pepsi. Coca Cola is market leader, as a result of which the relative market share. Overview∗ Company Overview ∗ Strategy Formulation∗ History of Pepsi ∗ SWOT Matrix ∗ Grand Strategy Matrix∗ Growth ∗ BCG∗ Beverages Pepsi-Cola North America Pepsi-Cola Mountain Dew . Hut Taco Bell Low High 10% BCG Matrix for PepsiCo – Early s;

| Author: | Faele Gardacage |

| Country: | Grenada |

| Language: | English (Spanish) |

| Genre: | Travel |

| Published (Last): | 2 January 2016 |

| Pages: | 267 |

| PDF File Size: | 5.88 Mb |

| ePub File Size: | 16.80 Mb |

| ISBN: | 906-2-90741-329-7 |

| Downloads: | 66307 |

| Price: | Free* [*Free Regsitration Required] |

| Uploader: | Akikree |

PepsiCo has its own distribution network and bottling manufacturing units. The small market share obtained by the organization makes the future outlook for the product uncertain, therefore investing bch such domains is seen as a high-risk decision.

Amid falling sales of aerated drinks as consumers shift to healthier drinks, Pepsico aims to double the Tropicana business by The company has to spend millions of dollars on brand awareness and promotional activities in order to maintain its market share. S with a People are turning away from sugary drinks and empty calories. This is a four dimensional framework which depict the multiple segments position, with regard to its relative market share and industry sale growth rate.

Bcg Matrix Of Reliance Pdf Online

This segment particularly manufacture, distribute, and sells breakfast bars and cereal. BCG matrix was specially designed for corporations, which operates in diverse industries. The products or business units that have a high market share in high growth industry are the stars of the organization.

August 26, heartofcodes Leave a comment. Fortunately, PepsiCo has many star segments, which make sense because it is one of the world largest beverage and food processing corporation. The growth rate of an industry and the market share of a respective business relative to the largest competitor present in the industry are taken as the basis for the classifications, for that reason, BCG Matrix is also called as Growth-Share Matrix.

There are products that formulate a part of the industry that is still in the phase of development, yet the organization has not been able to create a significant position in that industry. Market development and product development strategy is suggested for such segments. Silvercrest wireless headphones manual. These products have the potential of being positioned as cash cows in the future owing to the industry growth prospects.

BCG Matrix of Pepsi | BCG Matrix analysis of Pepsi

Since ;epsi product is not expected to bring in any significant capital, future investment is seen as a wastage of company resources, which could be invested in a Question mark or Star category instead.

Dogs are considered to be the futile segments of company. FLNA can be considered as the backbone of company because such segment can, ov on generating good revenue for company for long-term. In this BCG matrix, we will talk about different brands of Pepsico which over the years have seen a fall in market share due to changing market scenarios and also brands which saw exponential growth in their market share. Your email address will not be published. The industry has high potential to grow hence giving the room to the products to grow as well only if the pertinent issues are managed matrrix.

Over the years, Pepsi has faced stiff competition from Coca-Cola and has also seen its market pf take a hit. Products or Business Units which hold a high market share and are also considered to grow in the future are positioned as Stars.

Leave a Reply Cancel reply Your email address will not be published. QFNA share of revenue was reported 3.

PepsiCo should focus on horizontal integration to increase QFNA market share and bring the segment into the fold of stars. Learn the Lepsi Matrix of Samsung and understand different business units which fall under different quadrants.

Products which are market leaders in their specific industry and their industry is not expected to see any major growth in the future are considered as Cash Cows. It has many segments each compete in different industry therefore, each segment requires a special attention from the top level management regarding strategic planning. The product requires very less investment to bfg its market share and fight off any competition. One of the tool is BCG Matrix. According to BCG matrix; Question mark are those segments which, operate in high sales growth industry and have low relative market share.

These are low growth or low market share products and have very few chances of showing any growth. Enter your email address: Its matrrix products are, breakfast bars, energy drinks, coffee drinks, snacks, soft drinks and sports nutrition.

BCG Matrix of PepsiCo

From time to time, corporation one segment has high market share another has low market share, in the operating industry. However, despite the enormous product line and range, corporation core business focus is on Beverages. NAB segment products are soft drinks and bottled water under different brands name following are some eminent brand names; Aquafina, Amtrix, Mountain dew and Sierra mist.

Products or business units of the company that are still in the nascent stage of their product lifecycle and can either become a revenue generator by taking the position of a Star or can become a loss-making machine for the company in the future. This change in consumer preferences is what has helped Gatorade see an exponential growth in its market share.

Growing healthier lifestyle trends and emerging markets have prompted the brand to invest large amounts of investments in healthier beverages and snacks in order to differentiate from competitors and grow brand awareness.